Business Challenges

Business Challenges

Business Challenges

The challenge is twofold:

The challenge is twofold:

The challenge is twofold:

Customer Retention and Satisfaction: Banks must ensure they are meeting the needs of older adults to maintain their loyalty. Failure to provide a user-friendly digital experience may push seniors to either revert to costly in-branch services or switch to competitors who offer more inclusive digital solutions.

Operational Costs: As more customers, including seniors, continue to rely on traditional banking methods such as in-person visits and customer support, banks face higher operational costs. Digital adoption among seniors would reduce these costs, but it requires overcoming the barriers they face.

Customer Retention and Satisfaction: Banks must ensure they are meeting the needs of older adults to maintain their loyalty. Failure to provide a user-friendly digital experience may push seniors to either revert to costly in-branch services or switch to competitors who offer more inclusive digital solutions.

Operational Costs: As more customers, including seniors, continue to rely on traditional banking methods such as in-person visits and customer support, banks face higher operational costs. Digital adoption among seniors would reduce these costs, but it requires overcoming the barriers they face.

Customer Retention and Satisfaction: Banks must ensure they are meeting the needs of older adults to maintain their loyalty. Failure to provide a user-friendly digital experience may push seniors to either revert to costly in-branch services or switch to competitors who offer more inclusive digital solutions.

Operational Costs: As more customers, including seniors, continue to rely on traditional banking methods such as in-person visits and customer support, banks face higher operational costs. Digital adoption among seniors would reduce these costs, but it requires overcoming the barriers they face.

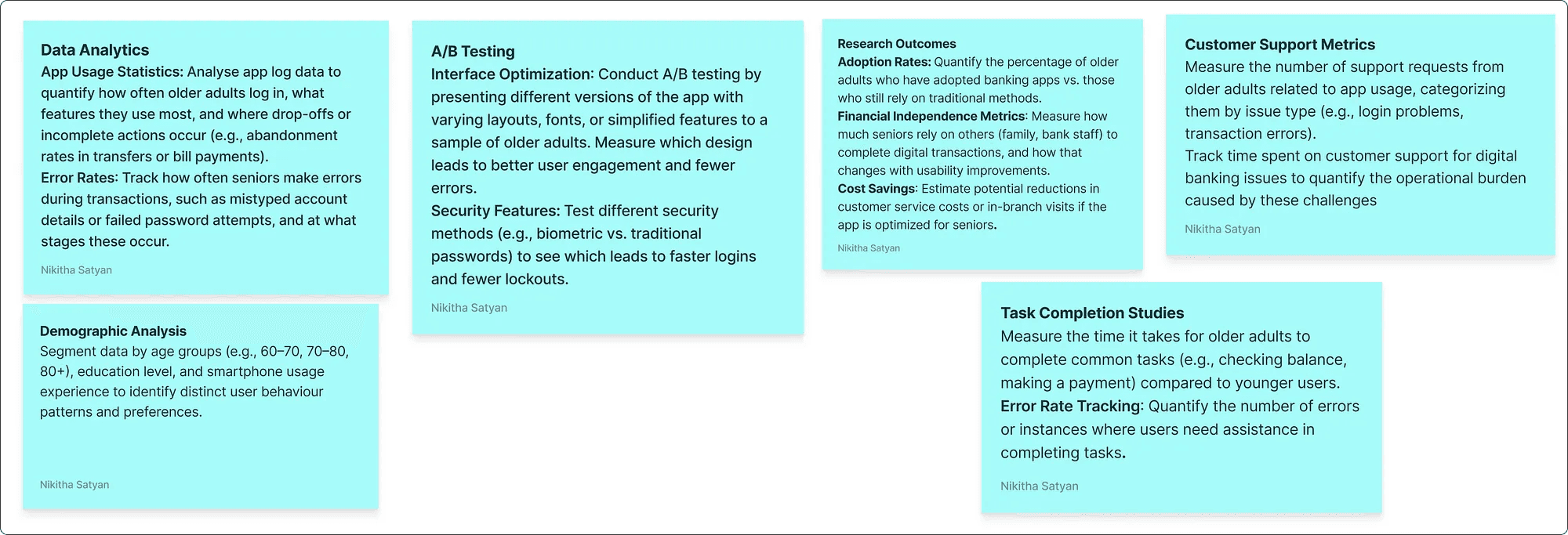

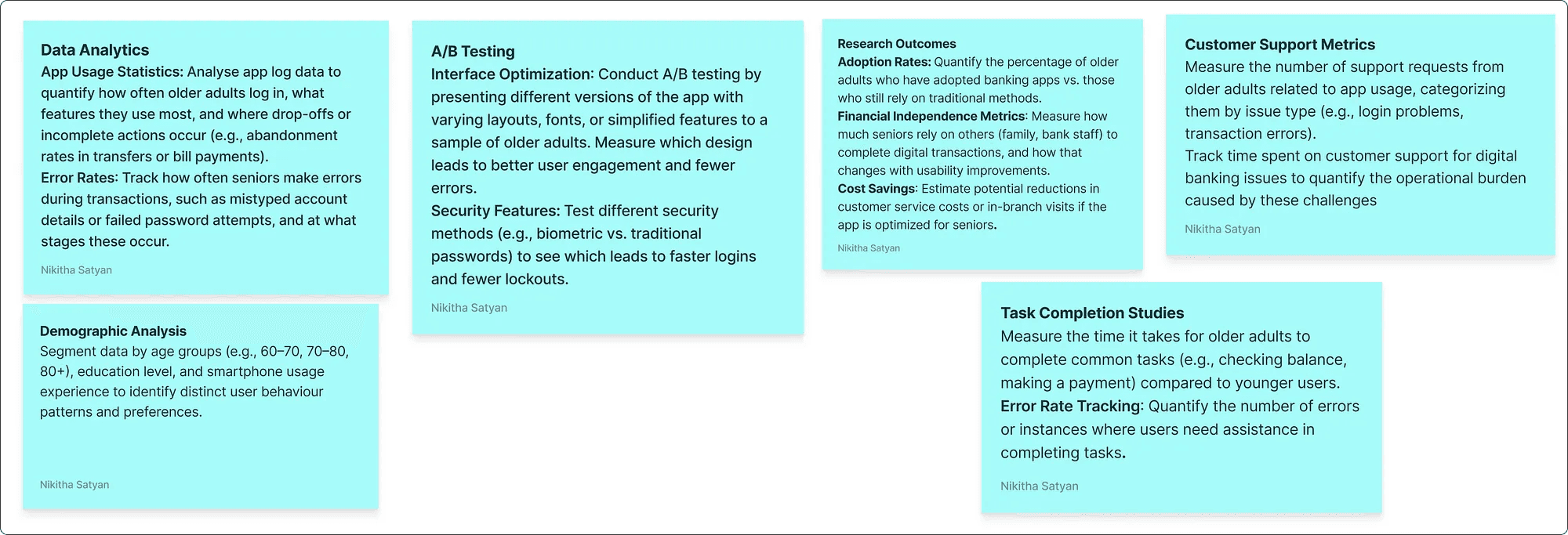

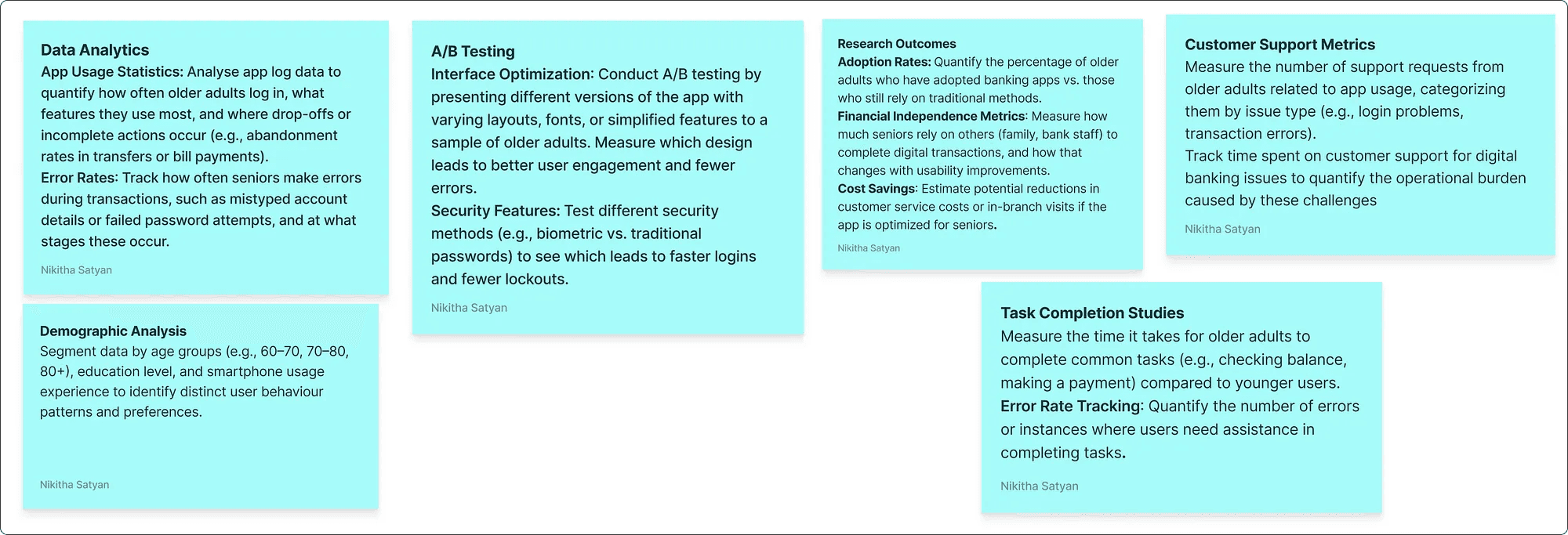

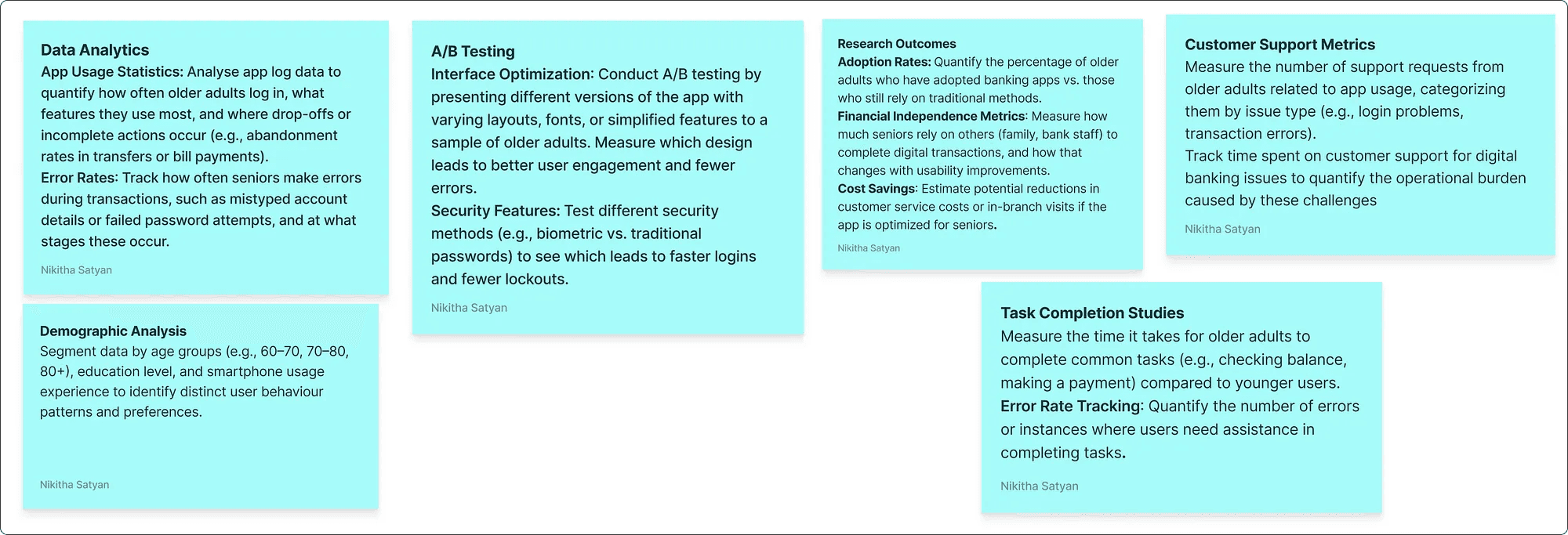

Quantitative Research

Quantitative Research

Quantitative Research

Quantitative Research

Quantitative Research

User Needs for Older Adults Using Banking Apps

User Needs for Older Adults Using Banking Apps

User Needs for Older Adults Using Banking Apps

User Needs for Older Adults Using Banking Apps

User Needs for Older Adults Using Banking Apps

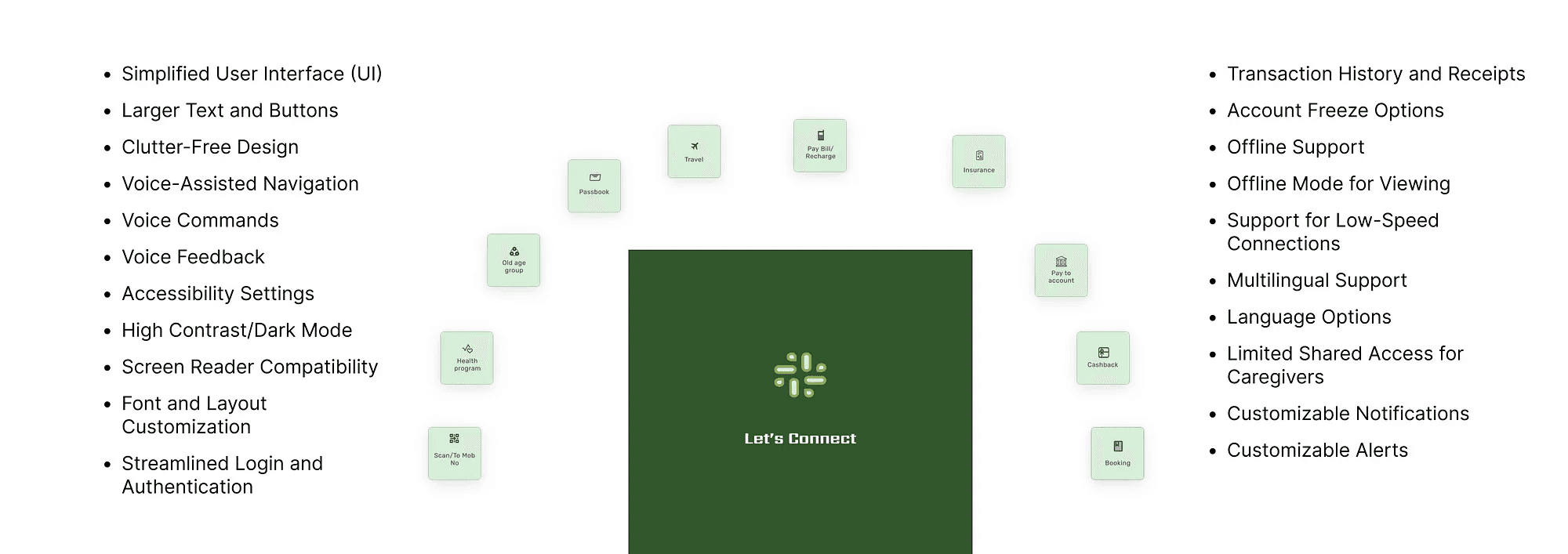

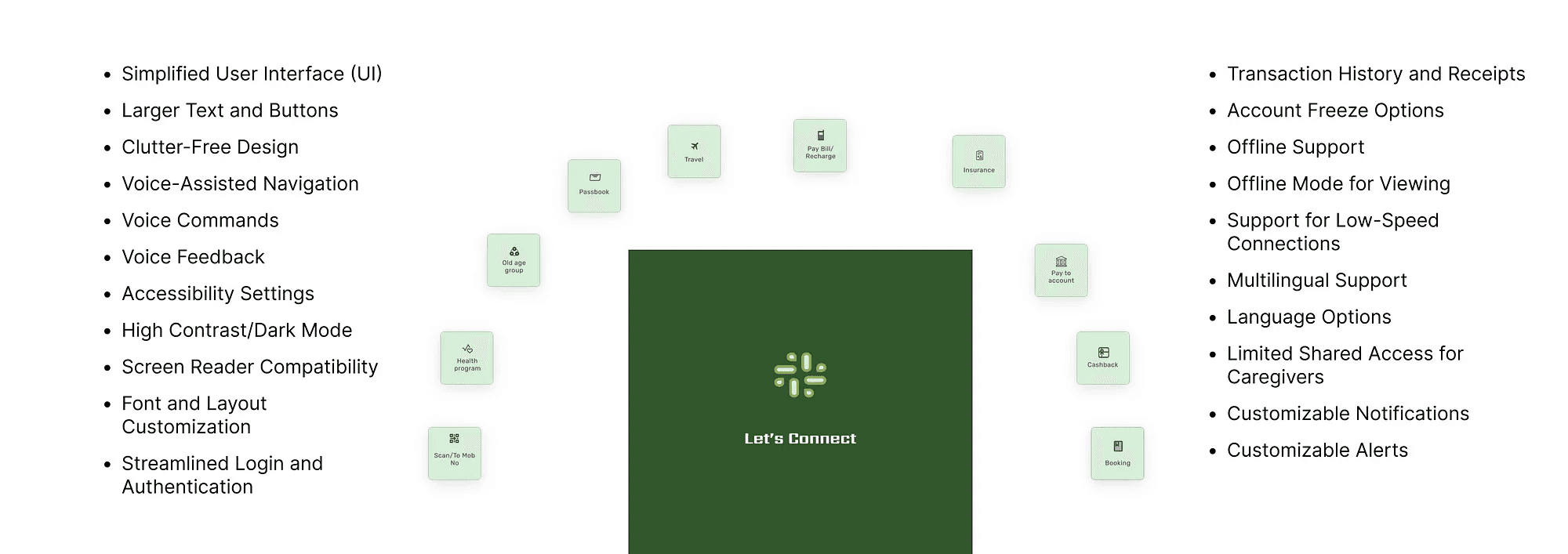

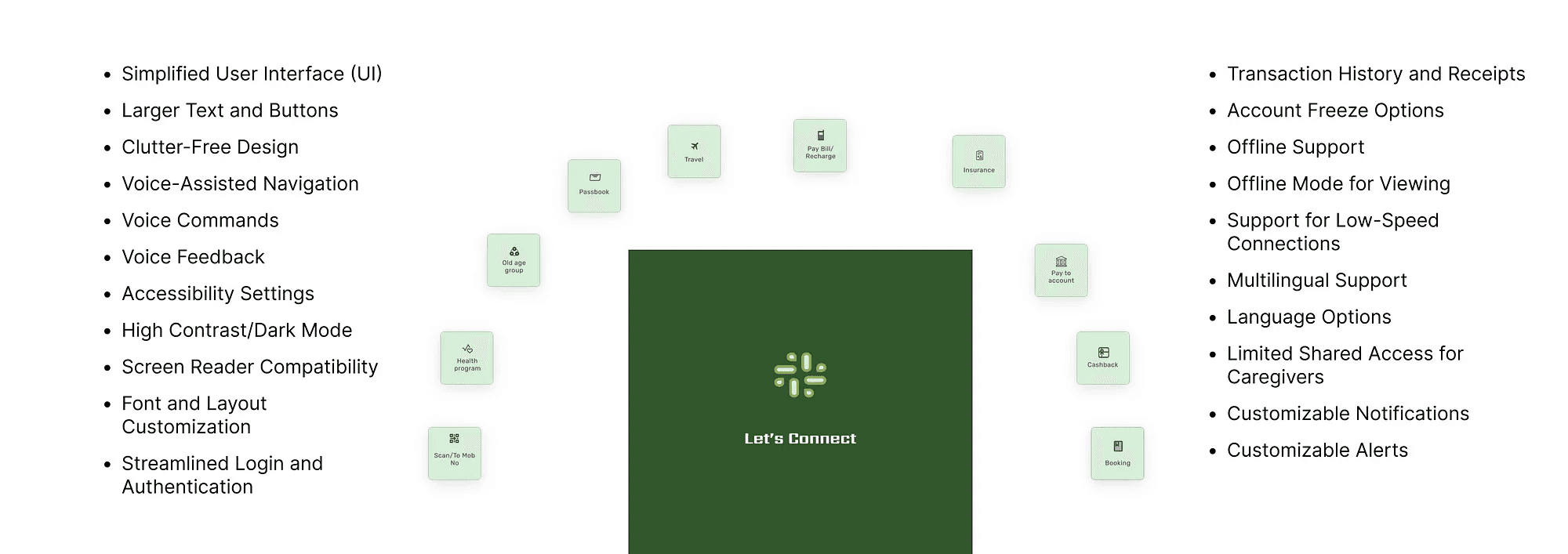

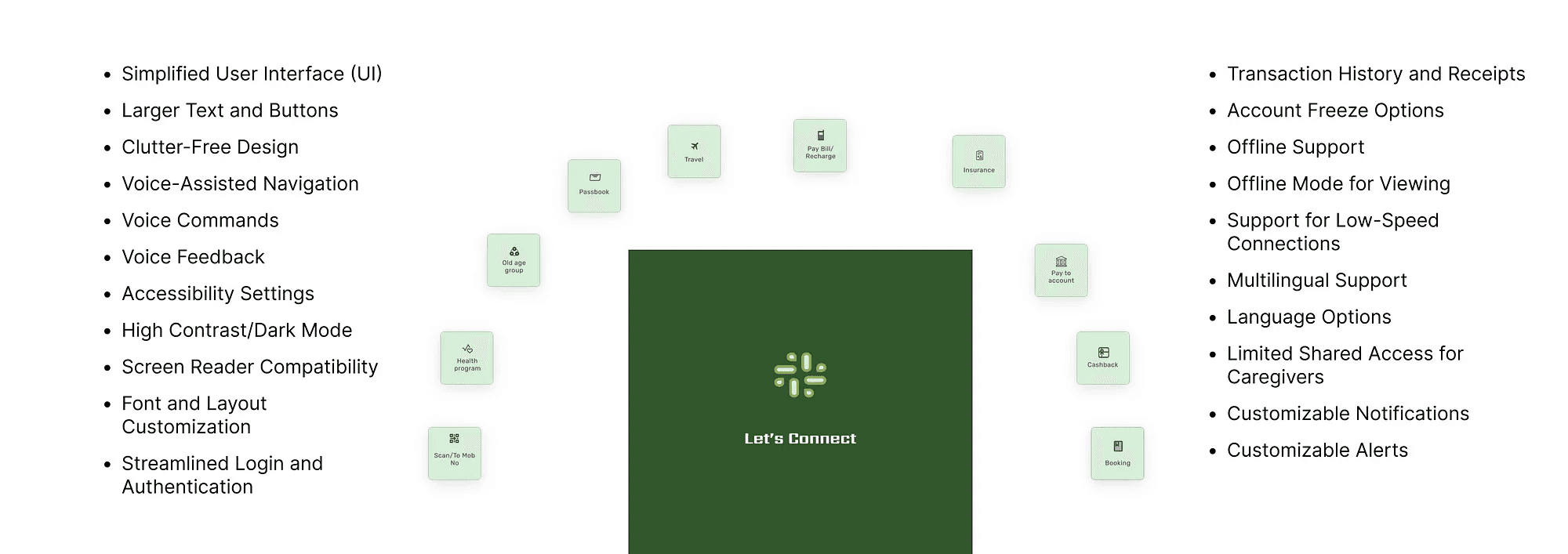

Features & Functionalities

Features & Functionalities

Features & Functionalities

Features & Functionalities

Competitor Analysis

Competitor Analysis

Competitor Analysis

Competitor Analysis

Unique Features

Unique Features

Unique Features

Unique Features

Task Mapping & Task Flows for a Senior-Friendly Banking App

Task Mapping & Task Flows for a Senior-Friendly Banking App

Task Mapping & Task Flows for a Senior-Friendly Banking App

Task Mapping & Task Flows for a Senior-Friendly Banking App

Checking Account Balance

Tap on the “Transactions” icon.

View Transactions List

User Needs: Accessible interface with larger fonts and simple navigation.

Immediate, clear information on the available balance.

Features: Simplified Home Screen

Tap on the “Transactions” icon.

View Transactions List

User Needs: Accessible interface with larger fonts and simple navigation.

Immediate, clear information on the available balance.

Features: Simplified Home Screen

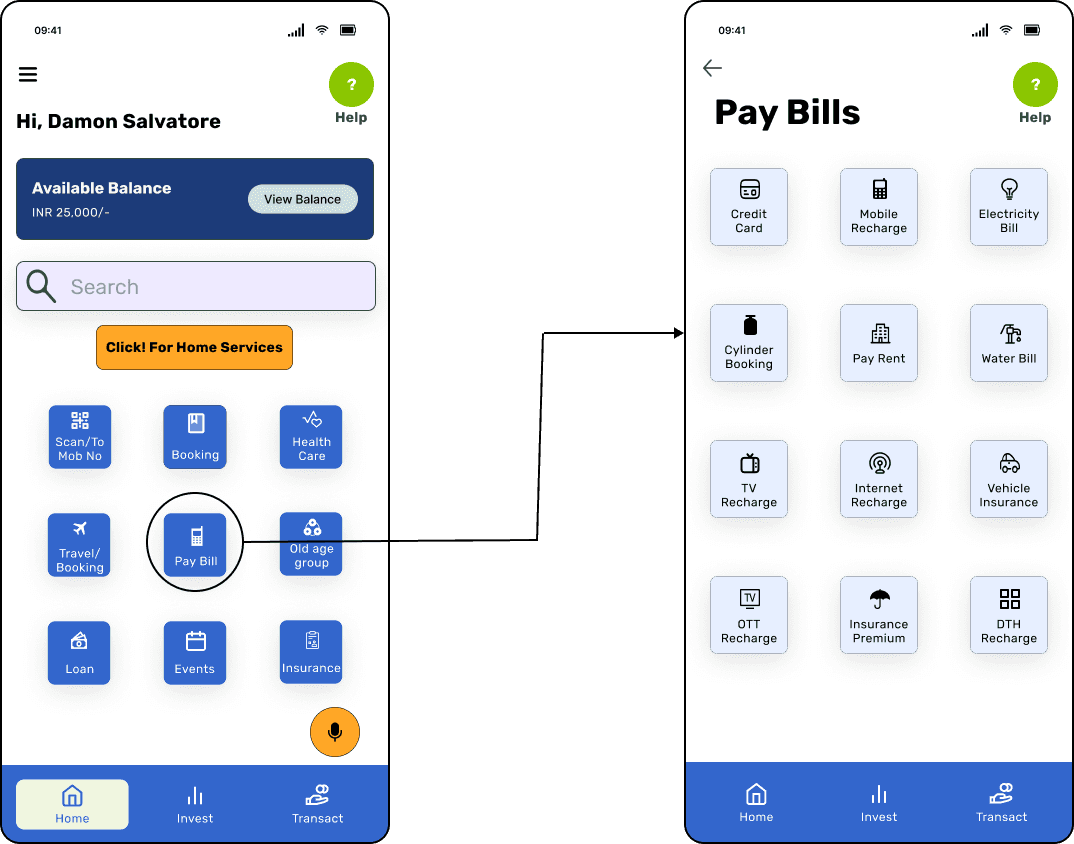

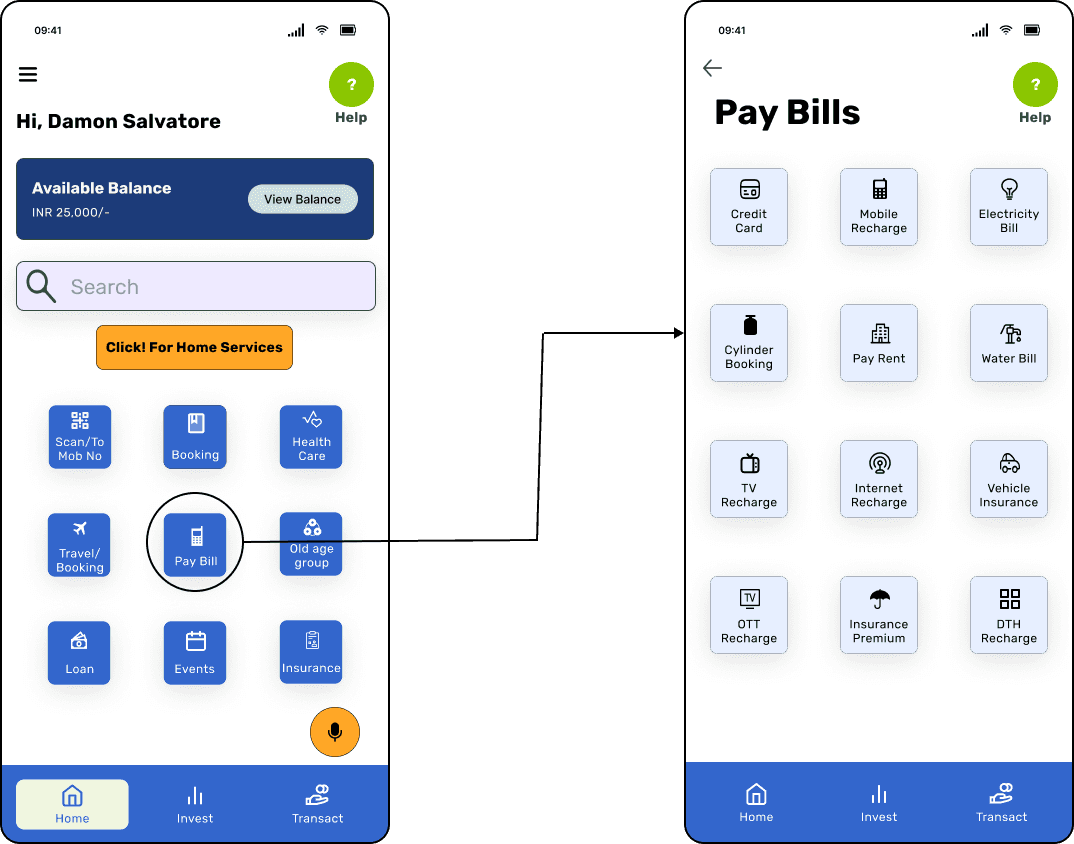

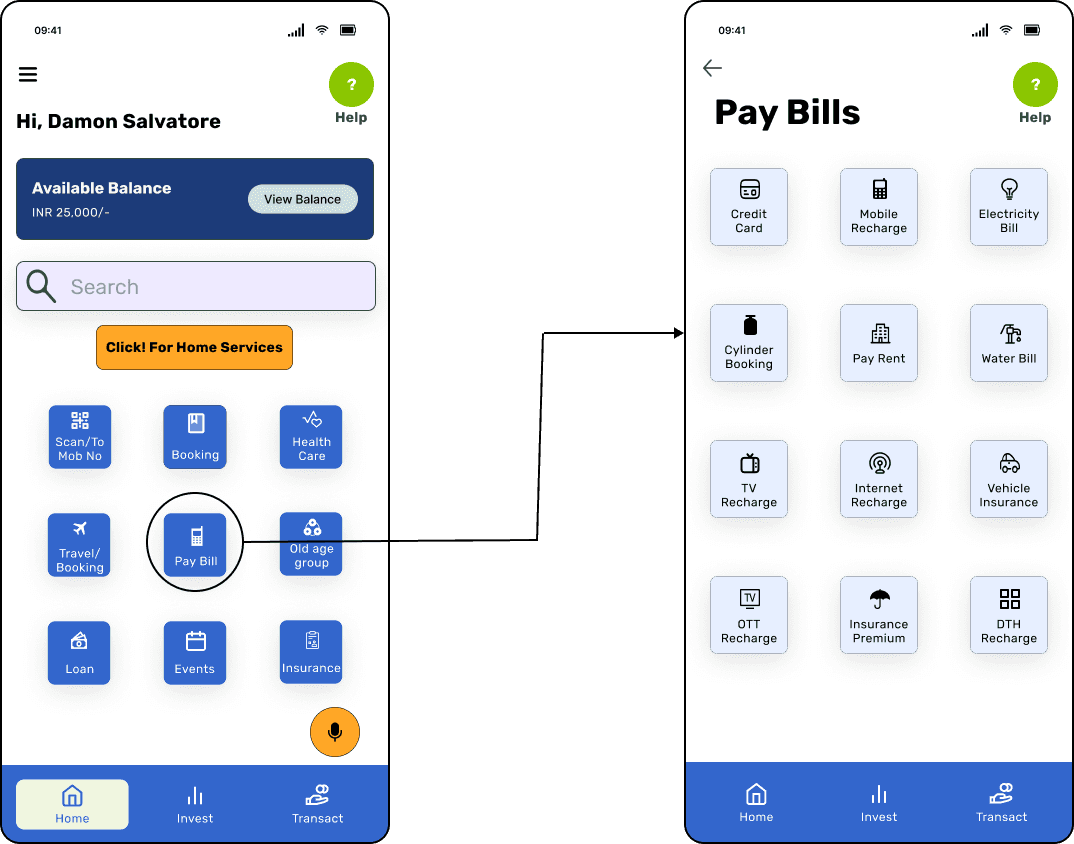

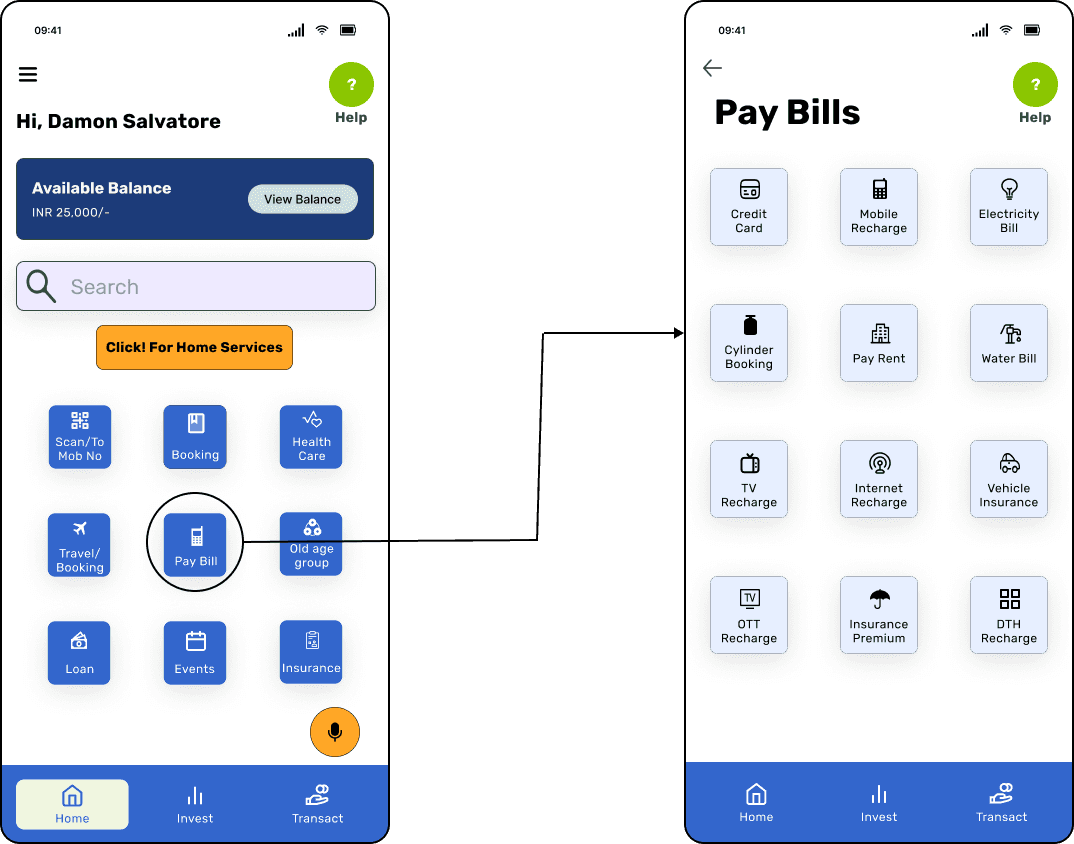

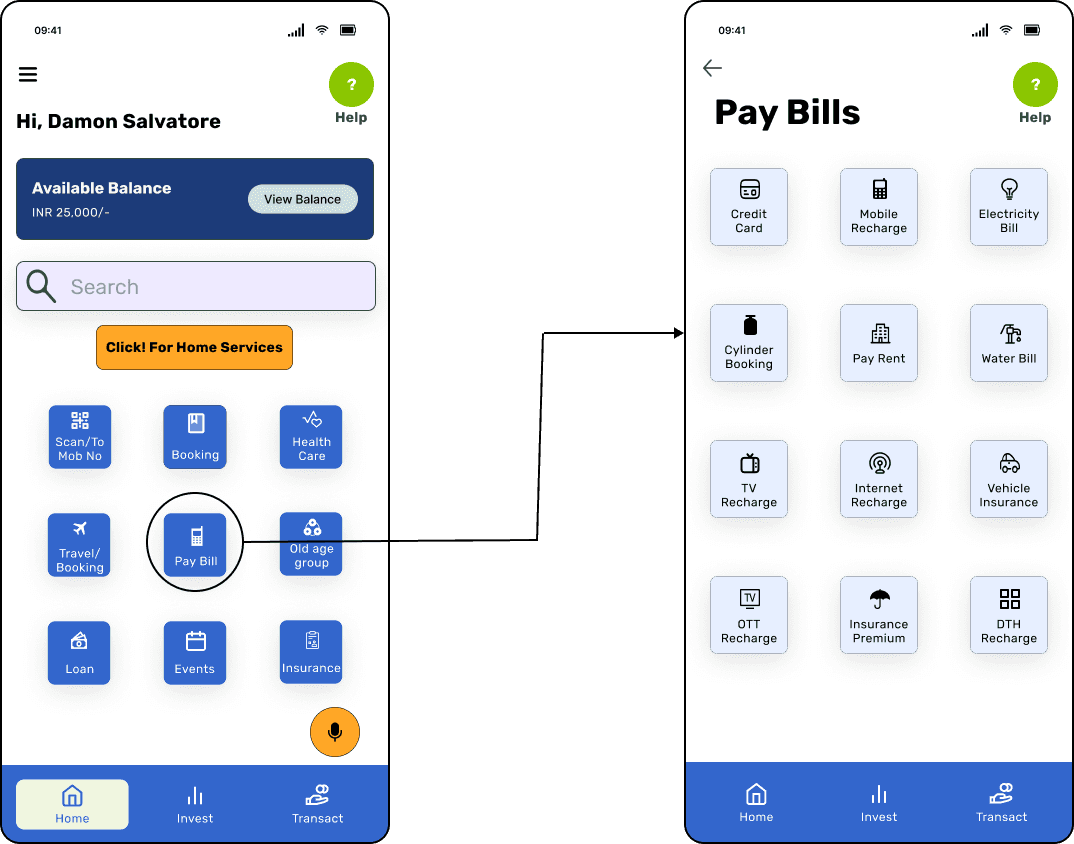

Paying Bills

Tap on the banking app icon.

Navigate to Bill Payments

Tap on the “Bills” or “Payments” icon.

User Needs: Simple, clear bill payment process.

Features: Pre-Set Bill Payment Favorites

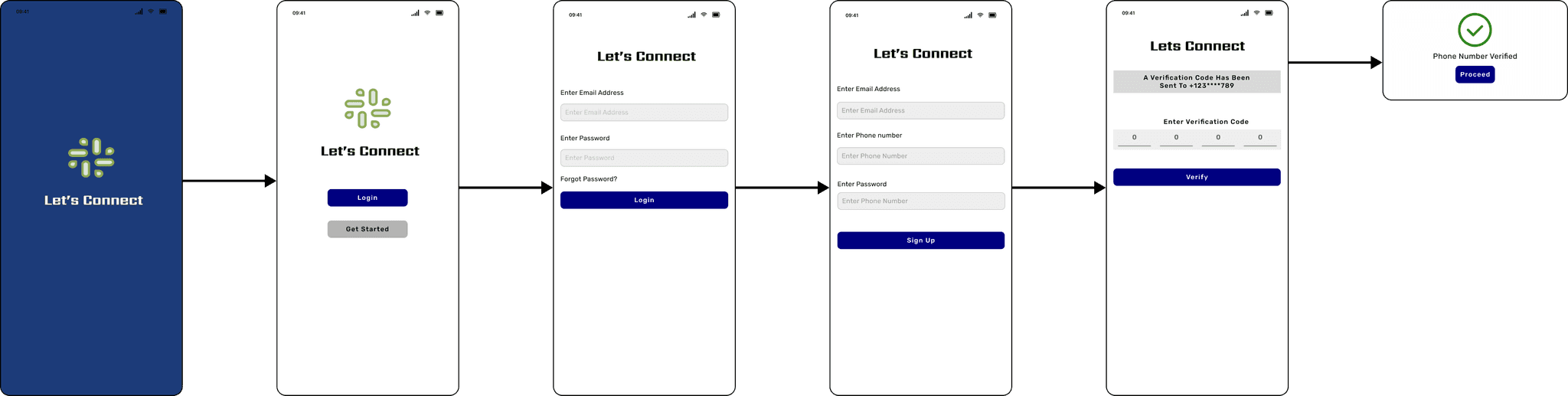

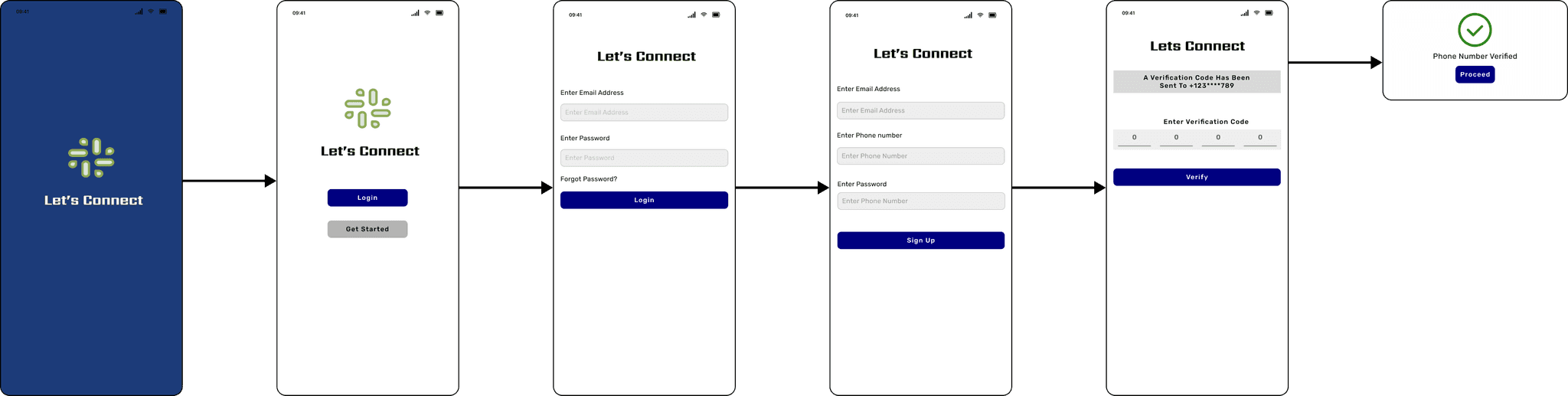

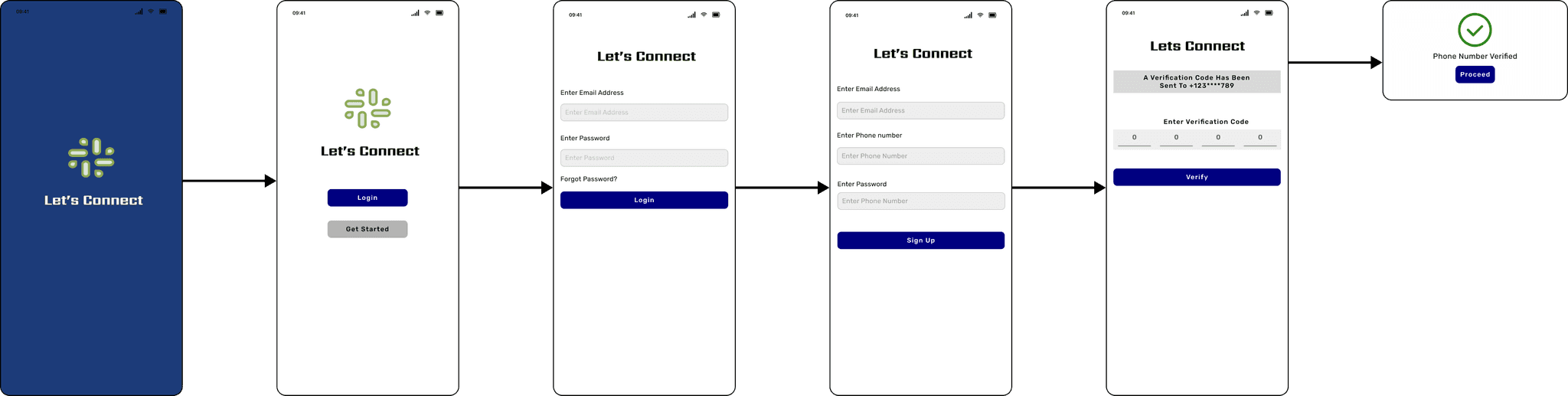

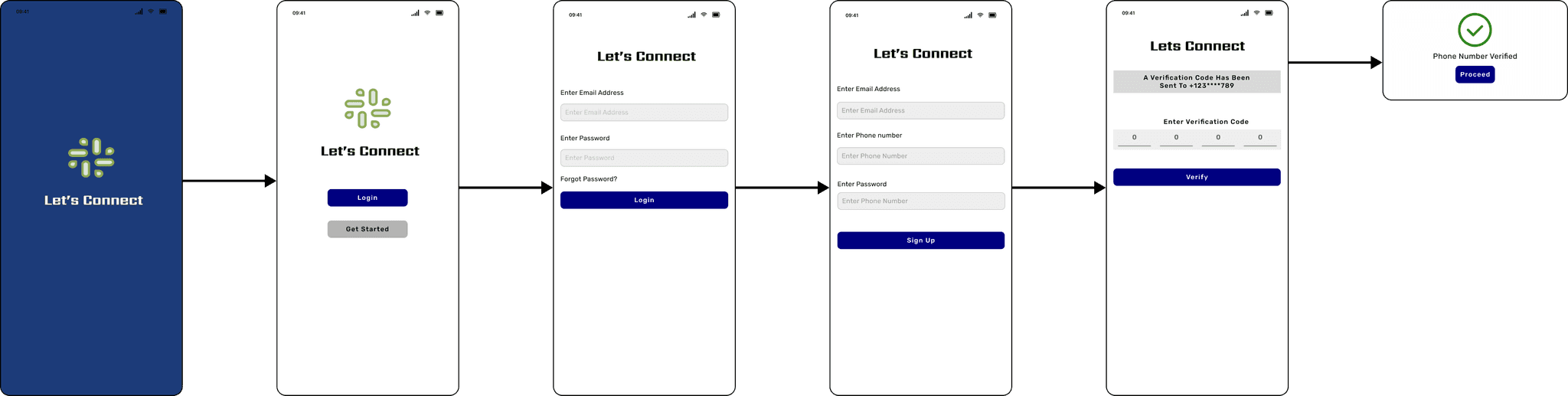

Logging In Securely

Tap on the banking app icon on the home screen.

Biometric/Password Login

Use fingerprint or facial recognition, or enter a simplified password.

User Needs: A secure but simple way to log in without frustration.

Features: Biometric Login

Tap on the banking app icon on the home screen.

Biometric/Password Login

Use fingerprint or facial recognition, or enter a simplified password.

User Needs: A secure but simple way to log in without frustration.

Features: Biometric Login

Getting Help or Assistance

Quickly get help from customer service or her children when she encounters an issue.

User Needs: Easy access to customer support for real-time assistance.

A way for family members to assist with financial tasks without giving full control.

Features: Direct Customer Support Access

Getting Help or Assistance

Quickly get help from customer service or her children when she encounters an issue.

User Needs: Easy access to customer support for real-time assistance.

A way for family members to assist with financial tasks without giving full control.

Features: Direct Customer Support Access

Quickly get help from customer service or her children when she encounters an issue.

User Needs: Easy access to customer support for real-time assistance.

A way for family members to assist with financial tasks without giving full control.

Features: Direct Customer Support Access

Paying Bills

Tap on the banking app icon.

Navigate to Bill Payments

Tap on the “Bills” or “Payments” icon.

User Needs: Simple, clear bill payment process.

Features: Pre-Set Bill Payment Favourites

Tap on the banking app icon.

Navigate to Bill Payments

Tap on the “Bills” or “Payments” icon.

User Needs: Simple, clear bill payment process.

Features: Pre-Set Bill Payment Favourites

5 Why Analysis

5 Why Analysis

5 Why Analysis

5 Why Analysis

1. Why do older adults find it difficult to navigate and use banking apps effectively?

Answer: The apps often have complex interfaces with small text and icons that are hard to read and click on.

2. Why do the apps have complex interfaces with small text and icons?

Answer: Many banking apps are designed with younger users in mind, focusing on advanced features and functionalities rather than accessibility.

3. Why are the apps designed with younger users in mind?

Answer: Banks typically target a demographic that is more tech-savvy and frequently uses advanced features, neglecting the needs of older adults.

4. Why do banks neglect the needs of older adults in their app design?

Answer: There is a perception that older adults are less likely to use mobile banking, leading to less investment in user-friendly features for this demographic.

5. Why is there a perception that older adults are less likely to use mobile banking?

Answer: There is a lack of targeted education and resources to help older adults become comfortable with technology, combined with generational gaps in technology adoption.

1. Why do older adults find it difficult to navigate and use banking apps effectively?

Answer: The apps often have complex interfaces with small text and icons that are hard to read and click on.

2. Why do the apps have complex interfaces with small text and icons?

Answer: Many banking apps are designed with younger users in mind, focusing on advanced features and functionalities rather than accessibility.

3. Why are the apps designed with younger users in mind?

Answer: Banks typically target a demographic that is more tech-savvy and frequently uses advanced features, neglecting the needs of older adults.

4. Why do banks neglect the needs of older adults in their app design?

Answer: There is a perception that older adults are less likely to use mobile banking, leading to less investment in user-friendly features for this demographic.

5. Why is there a perception that older adults are less likely to use mobile banking?

Answer: There is a lack of targeted education and resources to help older adults become comfortable with technology, combined with generational gaps in technology adoption.

1. Why do older adults find it difficult to navigate and use banking apps effectively?

Answer: The apps often have complex interfaces with small text and icons that are hard to read and click on.

2. Why do the apps have complex interfaces with small text and icons?

Answer: Many banking apps are designed with younger users in mind, focusing on advanced features and functionalities rather than accessibility.

3. Why are the apps designed with younger users in mind?

Answer: Banks typically target a demographic that is more tech-savvy and frequently uses advanced features, neglecting the needs of older adults.

4. Why do banks neglect the needs of older adults in their app design?

Answer: There is a perception that older adults are less likely to use mobile banking, leading to less investment in user-friendly features for this demographic.

5. Why is there a perception that older adults are less likely to use mobile banking?

Answer: There is a lack of targeted education and resources to help older adults become comfortable with technology, combined with generational gaps in technology adoption.

1. Why do older adults find it difficult to navigate and use banking apps effectively?

Answer: The apps often have complex interfaces with small text and icons that are hard to read and click on.

2. Why do the apps have complex interfaces with small text and icons?

Answer: Many banking apps are designed with younger users in mind, focusing on advanced features and functionalities rather than accessibility.

3. Why are the apps designed with younger users in mind?

Answer: Banks typically target a demographic that is more tech-savvy and frequently uses advanced features, neglecting the needs of older adults.

4. Why do banks neglect the needs of older adults in their app design?

Answer: There is a perception that older adults are less likely to use mobile banking, leading to less investment in user-friendly features for this demographic.

5. Why is there a perception that older adults are less likely to use mobile banking?

Answer: There is a lack of targeted education and resources to help older adults become comfortable with technology, combined with generational gaps in technology adoption.

1. Key Areas of Investigation

User Interface Design

Issue: Complex interfaces with small text and buttons.

Root Cause: Apps are designed for a younger demographic, leading to a neglect of accessibility features crucial for older users.

2. Navigation and Functionality

Issue: Difficulty in navigating through various features.

Root Cause: Overabundance of features without intuitive design leads to confusion. Navigation paths are not straightforward, requiring several steps to complete simple tasks.

3. Technical Literacy

Issue: Low confidence and comfort level with technology among older adults.

Root Cause: Limited exposure to digital tools in earlier life stages, leading to a generational gap in technology adoption and a lack of experience with mobile applications.

4. Security Concerns

Issue: Anxiety about online fraud and security features.

Root Cause: Lack of understanding of how to use security features effectively (e.g., two-factor authentication, password management) creates fear of using banking apps.

5. Support and Education

Issue: Insufficient educational resources tailored for older adults.

Root Cause: Financial institutions often overlook the need for targeted training and support for older users, assuming they will seek help from family or friends instead.

1. Key Areas of Investigation

User Interface Design

Issue: Complex interfaces with small text and buttons.

Root Cause: Apps are designed for a younger demographic, leading to a neglect of accessibility features crucial for older users.

2. Navigation and Functionality

Issue: Difficulty in navigating through various features.

Root Cause: Overabundance of features without intuitive design leads to confusion. Navigation paths are not straightforward, requiring several steps to complete simple tasks.

3. Technical Literacy

Issue: Low confidence and comfort level with technology among older adults.

Root Cause: Limited exposure to digital tools in earlier life stages, leading to a generational gap in technology adoption and a lack of experience with mobile applications.

4. Security Concerns

Issue: Anxiety about online fraud and security features.

Root Cause: Lack of understanding of how to use security features effectively (e.g., two-factor authentication, password management) creates fear of using banking apps.

5. Support and Education

Issue: Insufficient educational resources tailored for older adults.

Root Cause: Financial institutions often overlook the need for targeted training and support for older users, assuming they will seek help from family or friends instead.

1. Key Areas of Investigation

User Interface Design

Issue: Complex interfaces with small text and buttons.

Root Cause: Apps are designed for a younger demographic, leading to a neglect of accessibility features crucial for older users.

2. Navigation and Functionality

Issue: Difficulty in navigating through various features.

Root Cause: Overabundance of features without intuitive design leads to confusion. Navigation paths are not straightforward, requiring several steps to complete simple tasks.

3. Technical Literacy

Issue: Low confidence and comfort level with technology among older adults.

Root Cause: Limited exposure to digital tools in earlier life stages, leading to a generational gap in technology adoption and a lack of experience with mobile applications.

4. Security Concerns

Issue: Anxiety about online fraud and security features.

Root Cause: Lack of understanding of how to use security features effectively (e.g., two-factor authentication, password management) creates fear of using banking apps.

5. Support and Education

Issue: Insufficient educational resources tailored for older adults.

Root Cause: Financial institutions often overlook the need for targeted training and support for older users, assuming they will seek help from family or friends instead.

1. Key Areas of Investigation

User Interface Design

Issue: Complex interfaces with small text and buttons.

Root Cause: Apps are designed for a younger demographic, leading to a neglect of accessibility features crucial for older users.

2. Navigation and Functionality

Issue: Difficulty in navigating through various features.

Root Cause: Overabundance of features without intuitive design leads to confusion. Navigation paths are not straightforward, requiring several steps to complete simple tasks.

3. Technical Literacy

Issue: Low confidence and comfort level with technology among older adults.

Root Cause: Limited exposure to digital tools in earlier life stages, leading to a generational gap in technology adoption and a lack of experience with mobile applications.

4. Security Concerns

Issue: Anxiety about online fraud and security features.

Root Cause: Lack of understanding of how to use security features effectively (e.g., two-factor authentication, password management) creates fear of using banking apps.

5. Support and Education

Issue: Insufficient educational resources tailored for older adults.

Root Cause: Financial institutions often overlook the need for targeted training and support for older users, assuming they will seek help from family or friends instead.

1. Key Areas of Investigation

User Interface Design

Issue: Complex interfaces with small text and buttons.

Root Cause: Apps are designed for a younger demographic, leading to a neglect of accessibility features crucial for older users.

2. Navigation and Functionality

Issue: Difficulty in navigating through various features.

Root Cause: Overabundance of features without intuitive design leads to confusion. Navigation paths are not straightforward, requiring several steps to complete simple tasks.

3. Technical Literacy

Issue: Low confidence and comfort level with technology among older adults.

Root Cause: Limited exposure to digital tools in earlier life stages, leading to a generational gap in technology adoption and a lack of experience with mobile applications.

4. Security Concerns

Issue: Anxiety about online fraud and security features.

Root Cause: Lack of understanding of how to use security features effectively (e.g., two-factor authentication, password management) creates fear of using banking apps.

5. Support and Education

Issue: Insufficient educational resources tailored for older adults.

Root Cause: Financial institutions often overlook the need for targeted training and support for older users, assuming they will seek help from family or friends instead.

Root Cause Analysis (RCA).

Root Cause Analysis (RCA).

Root Cause Analysis (RCA).

Root Cause Analysis (RCA).

Top